how to add doordash to taxes

How Much to Pay DoorDash Taxes. Mileage and DoorDash taxes at the end of the year.

How To Get Doordash Tax 1099 Forms Youtube

Common deductions for DoorDashers include mileage and.

. How to File DoorDash Taxes. Choose the expanded view of the tax year and scroll to find Download Print Form just above the Close button. Tap or click to download the 1099 form.

Ad From Simple to Advanced Income Taxes. File DoorDash Taxes. A 1099-NEC form summarizes Dashers earnings as independent.

Dashers can deduct certain costs from their income to calculate their profits so you dont have to pay extra taxes on your expenses. IRS deadline to file taxes. In this video I will break down how you can file your taxes as a doordash driver and also what you can write-off and how you can calculate how much money you.

It may take 2-3 weeks for your tax documents to arrive by mail. In your DoorDash app tap the Account tab tap on Manage DashPass. Quickly Prepare and File Your 2021 Tax Return.

Next is to file the taxes. Each year tax season kicks off with tax forms that show all the important information from the previous year. This means for every mile you drive you pay 057 less in.

Does DoorDash send you. Choose the expanded view of the tax year and scroll to find Download Print Form just above the Close button. Like most other income you earn the money you.

There is no fixed rule about this. Internal Revenue Service IRS and if required state tax departments. Pull out the menu on the left.

DoorDash drivers are expected to file taxes each year like all independent contractors. You can do this with one of the. For 2020 the mileage reimbursement amount is 057.

DoorDash will file your 1099 tax form with the IRS and relevant state tax authorities. How do I track my taxes. Attractive pay with a side of flexibility makes on-demand food delivery an ideal way to put extra cash in your pocket.

- All tax documents are mailed on or before January 31 to the business address on file with DoorDash. Tax Forms to Use When Filing DoorDash Taxes. This means for every mile you drive you pay 057 less in.

DoorDash currently sends their. You should be keeping track of your work-related mileage. The Profit and Loss from Business form is used to add up all your income and then add up all your expenses.

You will receive your 1099 form by the end of January. All you need to do is track your mileage for taxes. You will simply need your 1099-NEC form which as stated earlier DoorDash will usually automatically send to you well in advance of tax filing time.

Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. The standard mileage rate allows you to claim a business expense of 575 cents per mile driven for your Doordash and other deliveries for the 2020 tax year 56 cents per mile. First make sure you are keeping track of your mileage.

The forms are filed with the US. You will be provided with a 1099-NEC form by Doordash once you start working with them. Youll receive a 1099-NEC if youve earned at least 600.

That said the rule of thumb is to set aside 30 to 40 of your profits to cover state and federal taxes. Tap or click to download the 1099 form. DoorDash will send you tax form 1099.

Its really simple to calculate your deduction. Paper Copy through Mail. Youll need your 1099 tax form to file your taxes.

Doordash 1099 Forms How Dasher Income Works 2022

How To Do Taxes For Doordash Drivers 2020 Youtube

Doordash Taxes And Doordash 1099 H R Block

You Can Make Decent Money On Doordash In 2022 You Just Need To Know How Use These Tricks From Top Earning Dashers To Level Up Your In 2022 Doordash Toy Car Level Up

How To File Taxes For Doordash Drivers 1099 Write Offs And Benefits Youtube

How To Become A Doordash Driver Doordash Driver Requirements Hyrecar

Doordash Taxes Does Doordash Take Out Taxes How They Work

Updated Doordash Top Dasher Requirement Note That Popped Up In The Dasher App Promising Top Dasher Will Now Give You Priority In 2022 Doordash Dasher Opportunity Cost

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

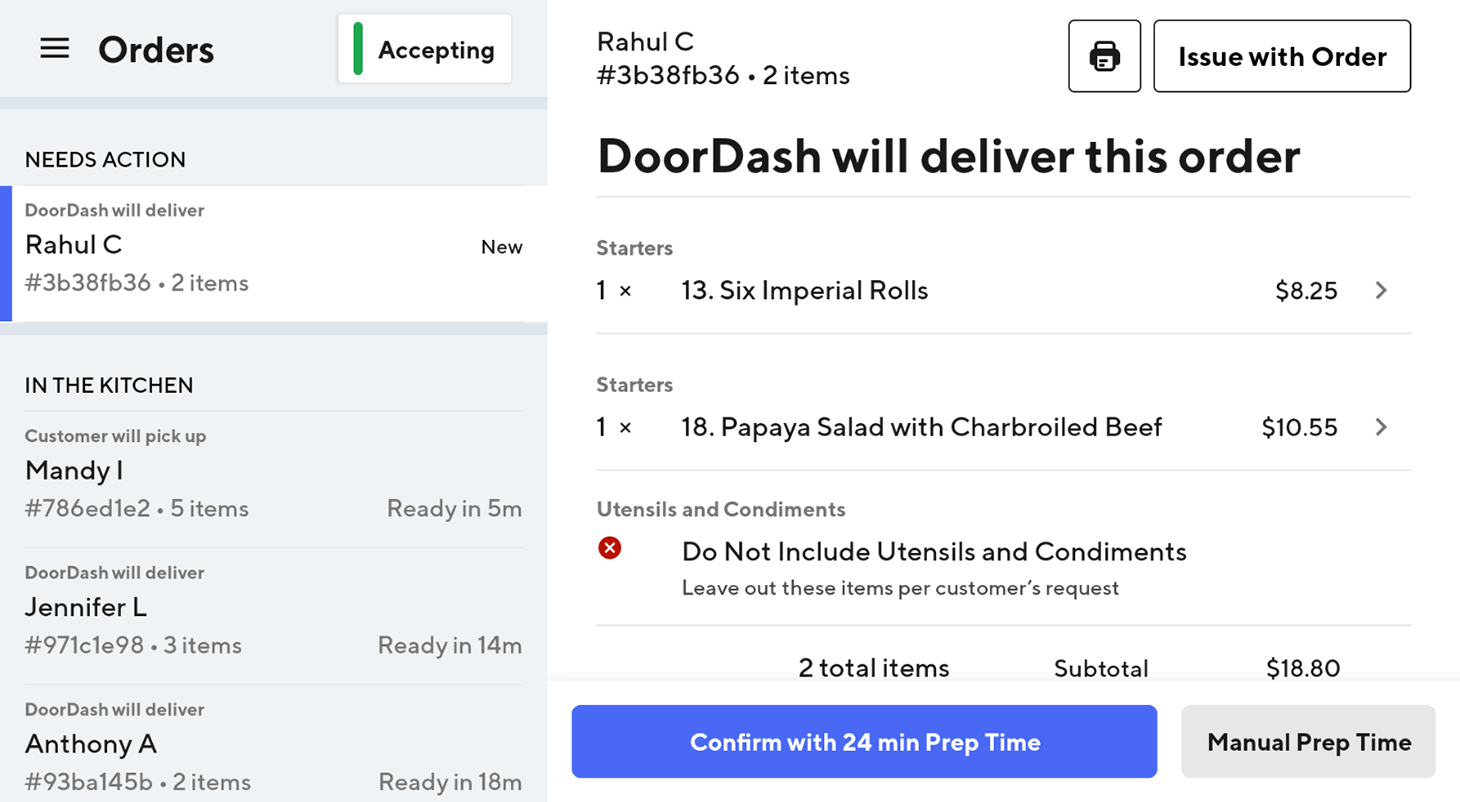

How Self Delivery Works Use Your Drivers And Dashers

How Many People Use Doordash In 2022 New Data